How to Apply for EPF Withdrawal Online using EPFO portal?

Individuals can benefit from the convenience of the withdrawal process of PF online.

Prerequisites:

1) Employees should, however, ensure that their contact number used to activate UAN is operational.

2) Besides, KYC verification and linking of the bank account via IFSC code should also be completed for each UAN for the application to proceed.

3) The Universal Account Number (UAN) must be activated, and the mobile number used for activating the UAN should be in working condition.

4) The UAN must be linked with the member’s KYC, such as the Aadhaar card, PAN and bank details with the IFSC code.

Online Application Submission

To understand how to withdraw PF amount online, follow the steps below-

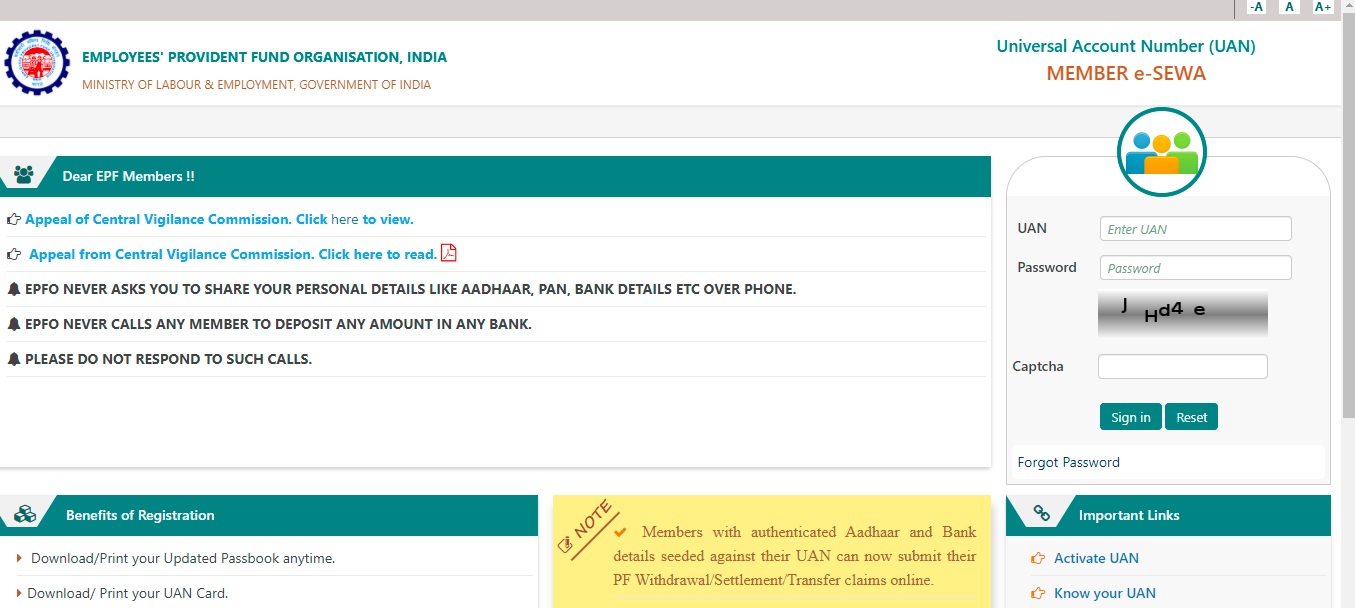

Step 1: Visit the official portal of EPFO.

Step 2: Use UAN and password to login into the EPF account. Enter the captcha to authenticate the login.

Step 3: Select the ‘Manage’ tab to access available options.

Step 4: Choose ‘KYC’ to determine whether the details provided via the KYC documents are authentic and accurate.

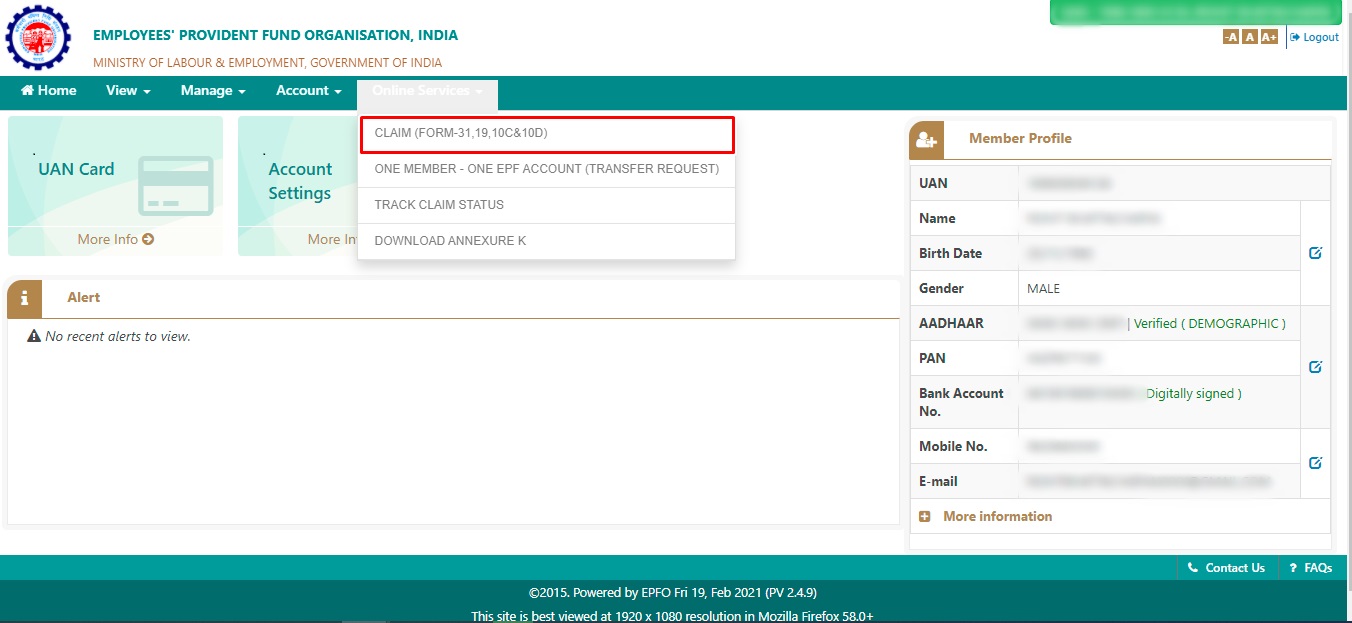

Step 5: Select the ‘Online Services’ tab.

Step 6: Choose ‘Claim (Form 31, 19 & 10C)’.

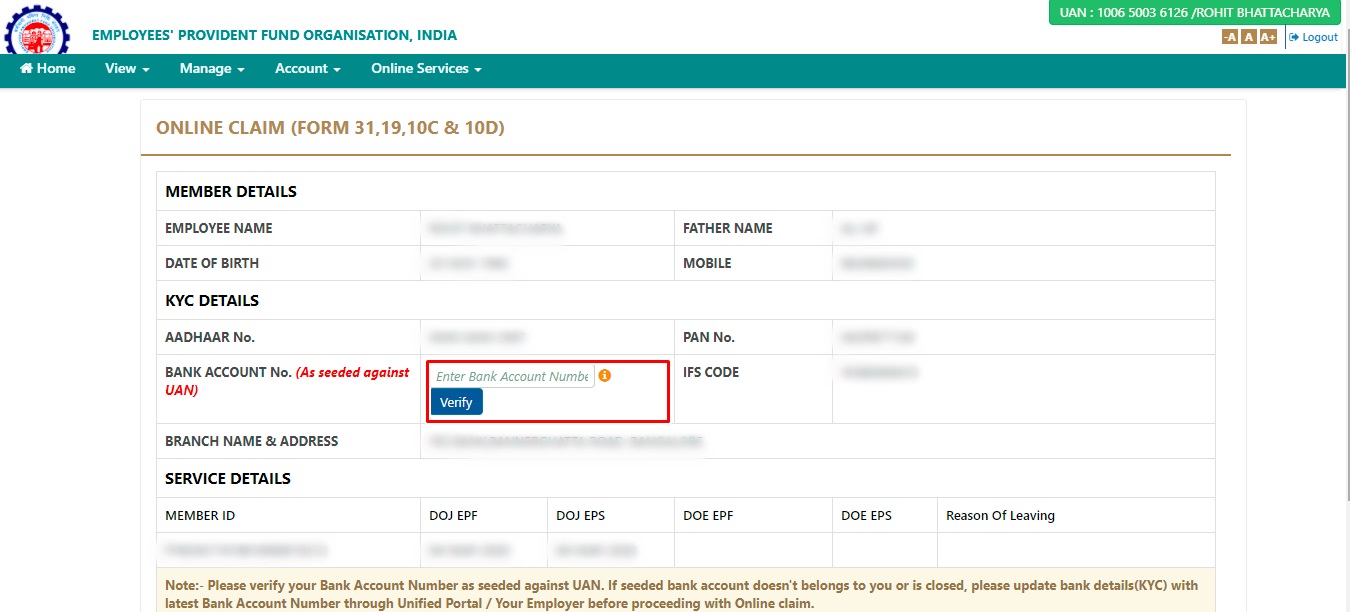

Step 7: Verify the details displayed on the current page. These include KYC information and additional service details.

Step 8: Input the last four digits of the registered bank account and click on ‘Verify’.

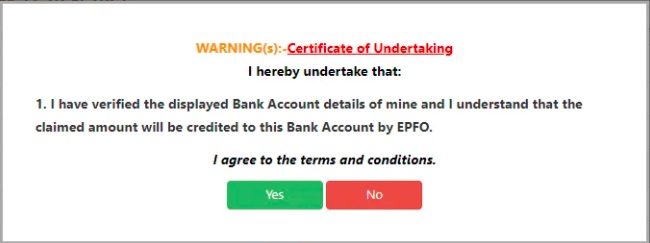

Step 9: Select ‘Yes’ for your online certificate of undertaking, stating that the EPF claim amount will be credited to the bank account mentioned.

Step 10: Click on ‘Proceed for Online Claim’.

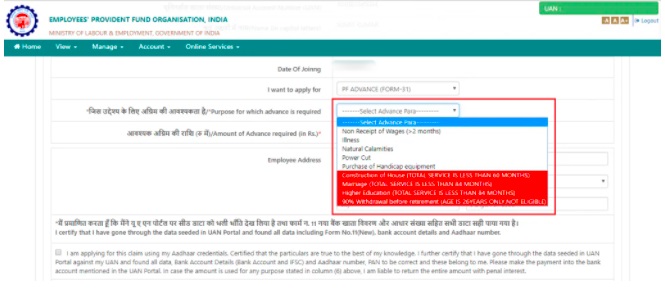

Step 11: Under the ‘I Want to Apply For’ option, select Full EPF Settlement, EPF Part Withdrawal, or Pension Withdrawal, as required.

Step 12: Choose the correct purpose under the ‘Purpose for which advance is required’ option.

Step 13: Enter the amount of advance required.

Step 14: Upload scanned documents required for approval. The employer is also required to approve this request for withdrawal to be complete.

Step 15: The EPF withdrawal amount is expected to be credited to an applicant’s bank account within 15-20 days from the date of application.

Comments

Post a Comment